After having given talks at the three past Q2B in Paris in 2023 on the Quantum Energy Initiative, 2024 on error correction and FTQC, and 2025 on FTQC roadmaps and on FTQC energetics, I participated for the first time to the Q2B in Santa Clara between December 9th and 11th, 2025 to deliver two talks (on use case/case studies analysis and on FTQC energetics, I’ll finish with that). The Q2B conferences who also happen in Tokyo are organized by QC Ware, a quantum computing software vendor based in the Silicon Valley.

That was for me the end of a three-week period full of events, which started with the France Singapore Symposium and the QUEST-IS conference on quantum engineering (my presentation there) and Teratec TQCI day on HPC-QPU integration, both in Paris.

The Q2B Santa Clara gathered a total of 150 speakers and 700 participants, the main room hosting about 200 to 300 of them at peak times. It was completed with a booth zone with about 20 exhibitors. The quality of an event comes with the speaker talks and the opportunities to meet interesting people within and outside your own field. For all these respects, I was pleased with the outcome and will share a couple related insights. In the audience, you had a few end-users, many service and software entrepreneurs (poke Renaud Béchade from Anzaetek, and Anastasia Marchenkova), some journalists, and quite a good number of investors.

Quantum scientists

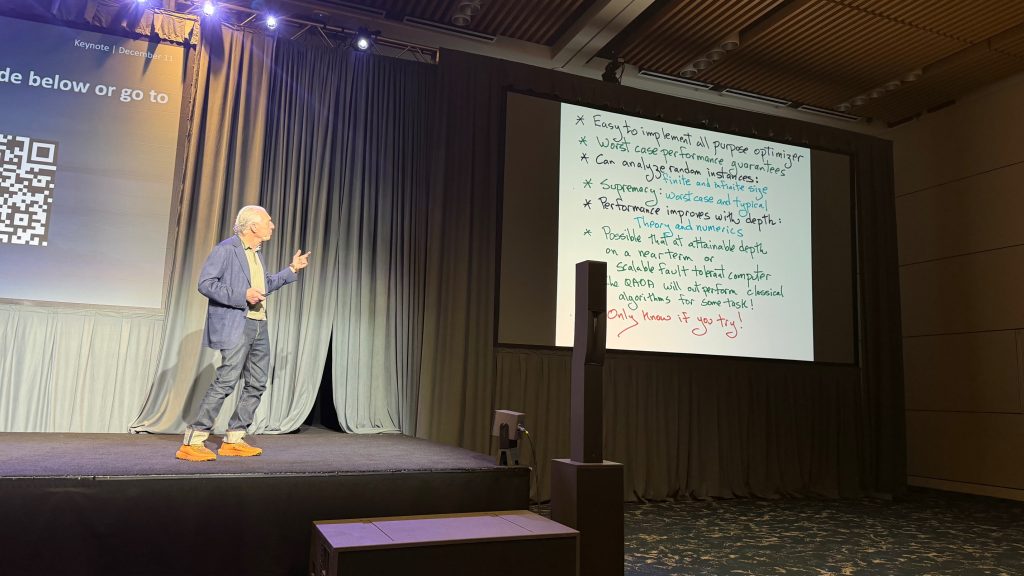

This Q2B was welcoming as usual Scott Aaronson (Texas University) and John Preskill (Caltech) who described their “state of the union” views of quantum computing. Scott commented on the fuss generated by a recent post where he inventoried recent advancements in quantum computing and described the first NISQ verifiable quantum advantages (from BlueQubit and Quantinuum). This time, John Preskill didn’t invent a new acronym. Edward Farhi from Google delivered a talk on QAOA with unique handwritten slides.

So, how’s the quantum computing union? It’s still in some superposed Bell state with NISQ (aka noisy short-term quantum computers) being still in the game for some and not for others, and FTQC (the ones using quantum error correction and fault-tolerance), the Holy Grail in most hardware vendor roadmaps. In a couple words, NISQ is not dead yet, and FTQC is not yet alive.

Quantum computing hardware vendors

This sort of event is an opportunity to discover new players in that field or get updates for known ones. All of them were not there for multiple reasons. IBM organized its own developer conference in November. Some key EU players were missing.

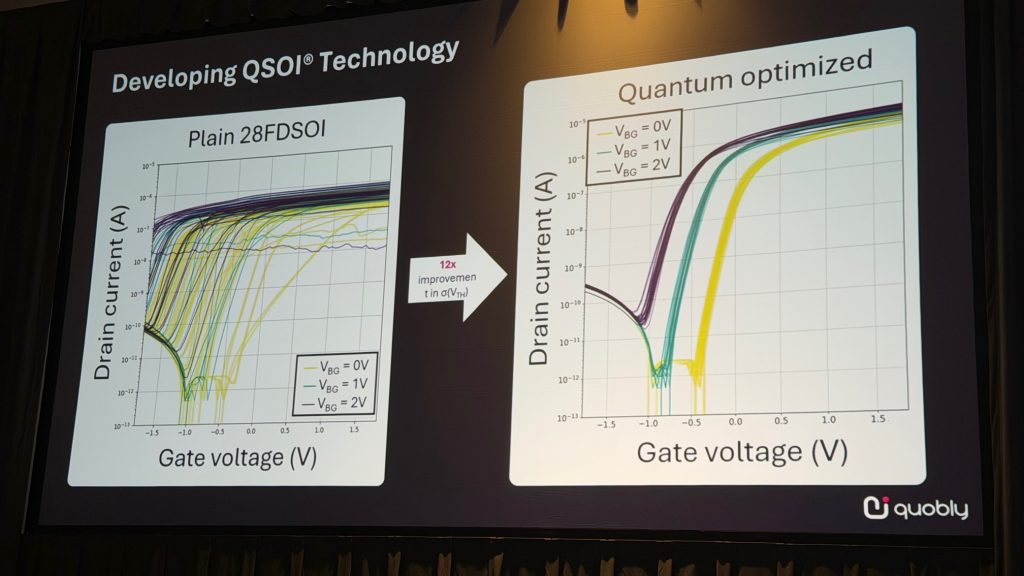

Quobly was represented by Maud Vinet (CEO) and Nicolas Daval (Chief Engineering Officer) with an update on their R&D work, focusing on their partnership with STMicroelectronics that Maud announced at the Q2B Santa Clara 2024. They use an industry-grade fab to manufacture 300 mm silicon wafers using the QSOI technology for the creation of silicon qubits on FD-SOI wafers. They exhibit very good results at the basic operations level of their circuits. Maud Vinet also did an excellent presentation at the France Singapore symposium, completed by another one from Tristan Meunier (Chief Scientist and Innovation Officer) at the QUEST-IS conference.

Diraq was represented by Andrew Dzurak (CEO). They also develop silicon qubits, with manufacturing spread over two partners: Global Foundries for cryo-CMOS qubit control chips and IMEC for the qubit chips. The company published simultaneously a preprint describing a first 8-qubit chip with low-level characterization: Eight-Qubit Operation of a 300 mm SiMOS Foundry-Fabricated Device by Andreas Nickl, Nard Dumoulin Stuyck, Tuomo Tanttu, arXiv, December 2025 (11 pages). But as for Quobly, not yet 2-qubit gates.

C12 was represented by Pierre Desjardins (CEO). The Paris-based startup is developing carbon nanotube-based qubits with an original way to connect qubits using superconducting electronics on silicon chips.

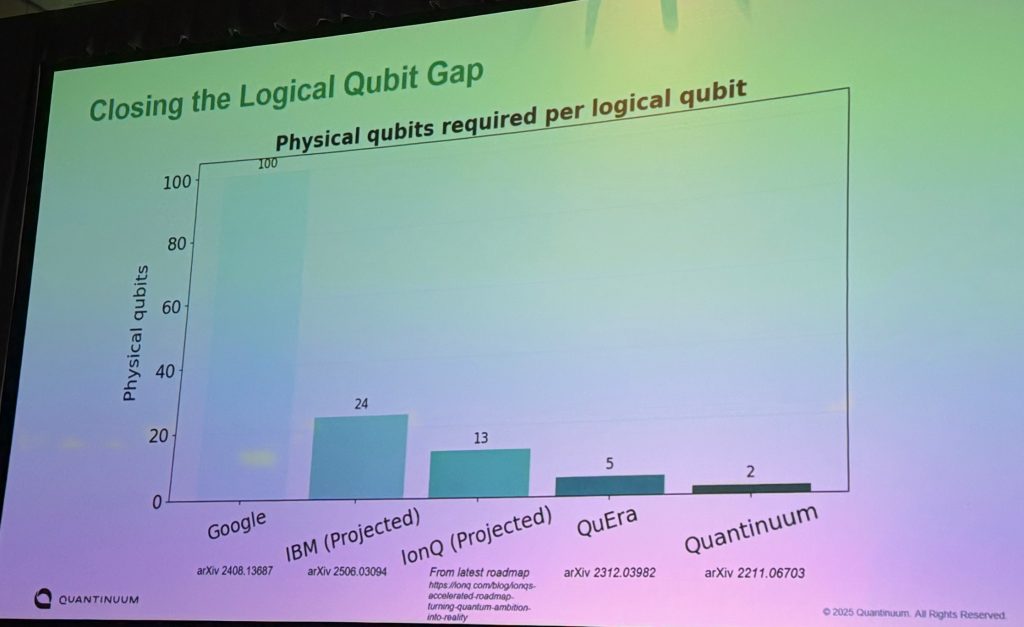

Quantinuum made some updates on their roadmap and on the recent Helios 98-qubit quantum computer released a couple weeks ago (Tanya Roussy and Mark Jackson). There was no new news there. Tanya Roussy promoted the low encoding rate of their logical qubits experimented on Helios which requires 2 physical qubit per logical qubit when compared to other experiments (Google Willow, QuEra, etc). Indeed, high-fidelity trapped ions qubits may require a lower overhead, but this comparison doesn’t make any sense if you don’t exhibit the fidelity gains of these logical qubits and their coverage (memory, single and two qubit gates, T/Toffoli gate generation). The company now has 640 people and deployed 5 commercial quantum computers. Helios is consuming the equivalent of 17 hair driers, so about 34 kW. In their roadmap, Lumos should be released in 2030+ with one million physical qubits. Many of their presented customers are in the life science domain (Amgen, Sanger Institute, Crown Bioscience).

Qudora which was represented byJani Heikkinen (VP Business Development) is a German trapped-ions startups with 35 people, developing near field microwave driven trapped ions chips. They plan to reach 200 qubits in 2027. They demonstrated fidelities of 99.7% in academic setups. They say they use “clock qubits” which correspond to the use of hyperfine atomic clock transitions to encode data, controlled by microwaves.

Bosoniq is a new startup based in New Jersey developing a distributed trapped ions based computing platform. They start with 36-qubit nodes using microwave driven qubit gates, and optical-cavities photon interconnect.

Photonic Inc was represented by Stephanie Simmons (CEO). Their technology is using hydrogen cavities in silicon and photonic interactions between these cavities as well as between computing units, enabling them to scale well. When asked about figures of merit data, the CEO said it was confidential information reserved to customers and investors. I am not sure that this the right practice to drive trust in this industry.

Quantum Transistors who was represented by Shmuel Bachinsky (CEO). It is an israeli startup developing NV-center based quantum computers. They exhibit two-qubit gate 99.9988% fidelity at 4K, use silicon nitride chips for photonic operations based on optical photons to drive non-local connectivity between qubits. Their test chip hosts 16 qubits with many to many connectivity. They plan to create stacked chips supporting 25 qubits per mm2 on 20x20mm, making it 10K qubits chips. They diamond qubits are 4 microns long. Their roadmap plans for the support of 250K qubits by 2030 with at 10^-5 error rates. They build their diamond chips with the Israeli consortium diamondSEMI-IL. Qubit readout used to be based on SPADs and is moving to SNSPDs which requires some cooling below 4K.

Xanadu was represented by Rafal Janik (COO). There were not many details on their planned FTQC hardware, whose sizing is gigantic, based on their 2025 papers, mentioning the need for tens of thousands of racks. The presenter said that their system needs no cooling for computation. Indeed, but it is still required for photon detection which is currently based on superconducting transition edge sensor (TES) detectors, which are developed in partnership with Applied Materials.

There were also talks or panel participation, more business oriented, from IonQ, Infleqtion, QuEra, Quantum Computing Inc and IQM.

Quantum computing enabling hardware technologies were covered with Quantum Machines (the worldwide leader of qubit control electronics), Orange Quantum Systems (with its qubit chip testing systems), Delft Circuits (with an interesting and detailed roadmap for the support of thousands of solid state qubits), Qblox(qubit control) and QuantWare (these four being part of a significant Dutch delegation led by Quantum Delta).

Quantum computing software

Ryan Babbush from Google made a presentation based on a recent paper he coauthored: The Grand Challenge of Quantum Applications by Ryan Babbush, Robbie King, Sergio Boixo, William Huggins, Tanuj Khattar, Guang Hao Low, Jarrod R. McClean, Thomas O’Brien, and Nicholas C. Rubin, arXiv, November-December 2025 (22 pages). It provides a clear understanding of the path to real world use cases and case studies.

Quemix (Japan) presented use cases of quantum computing for Computer-Aided Engineering (CAE) applications which they developed for Sumitomo Rubber Industries. They propose a Fourier space readout method that removes the measurement bottleneck in quantum CAE and could enable exponential speedups for large-scale simulations. So far, their tests are done with Quantinuum H1-1 20-qubit quantum computer.

Quminex made a pitch in the use of AI and quantum computing for improving the discovery of minerals (Co, Cu, Ni, Zn).

There were also presentations from Quantum Rings, NeoQortex, Blue Qubit, and Moth from the UK (which is focusing on gaming). Riverlane, Q-CTLR, Classiq, Horizon Quantum and Entropica Labs were also delivering talks. Phalgun Logur from Capgemini did two talks on quantum chemistry. Speakers from AWS, HPE, Dell and OrionX (Shahin Khan) delivered interesting talks related to the relationship between HPC and quantum computers.

Other topics

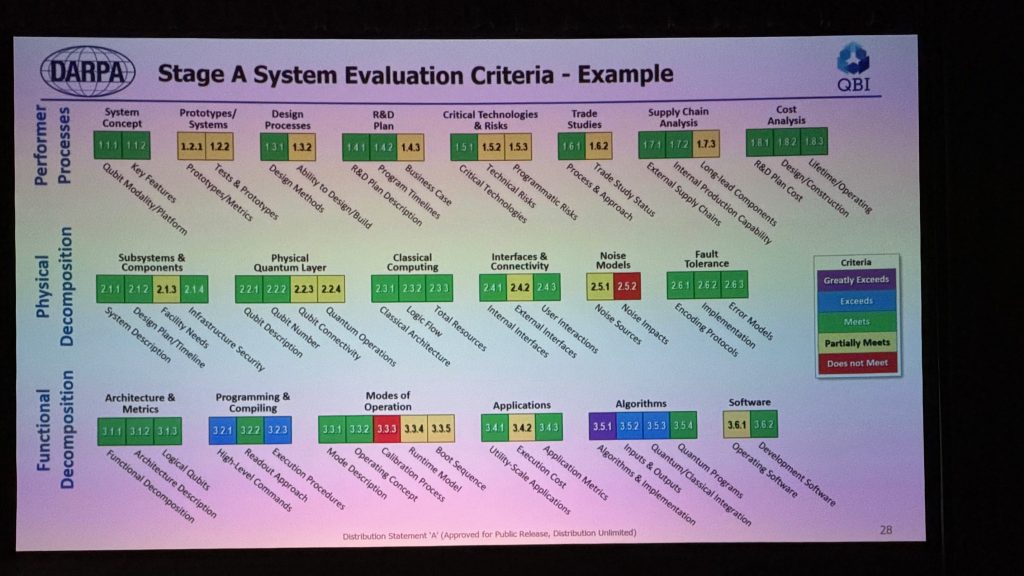

Joe Altepeter presented the DARPA QBI program that he runs. It is amazing to learn that the equivalent of 225 full-time employees analyze the submissions from about 20 industry vendors, spread across 14 organizations including DARPA, the most active being scientists from the various DoE labs. Below, the criteria used to evaluate the QBI participants. There was also a talk from Michael Hayduk from AFRL, that I missed.

On the investor side, Helmut Katzgraber from QuNorth presented this new fund which ambitions to be the first pure player in quantum technologies. They have raised so far 134M€, and are therefore still a bit smaller than Quantonation, which has over 30 partipations while QuNorth has invested in two companies: IQM and Kiutra (a German magnetic cryogenic vendor).

Celia Mertzbacher from QED-C did an interesting presentation on the state of the quantum market, highlighting that uncertainty drives anxiety. The quantum computing market is growing, witg $1B revenue in 2024 and $2.2B anticipated in 2027. She noticed that on-premise quantum computing usage is growing up.

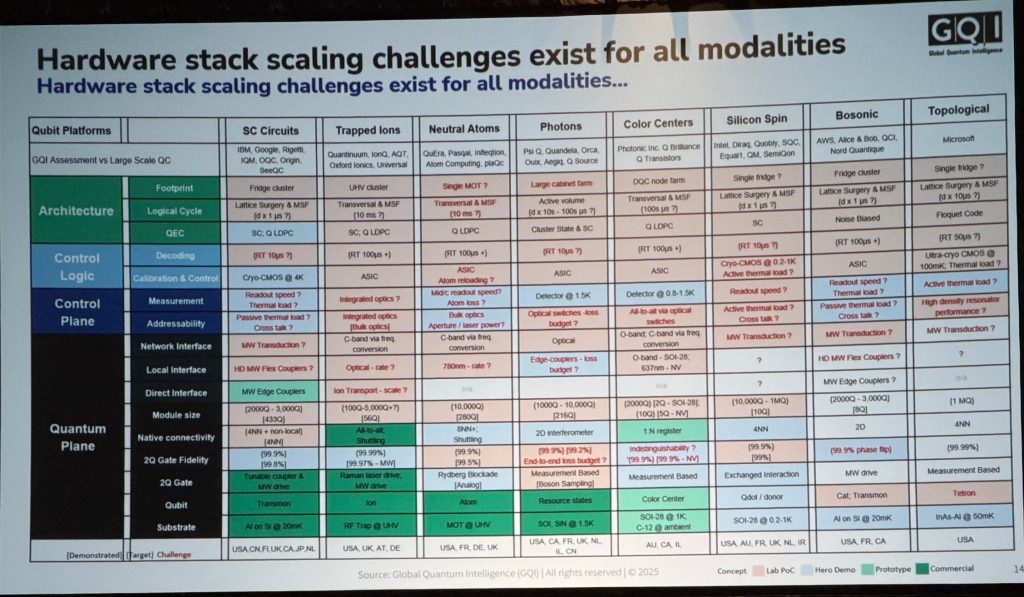

There were also ritual analysts talks with Bob Sutor, Doug Finke (GQI, with quite sophisticated market maps like below), Bob Sorensen (Hyperion), Daniel Beaulieu (Deloitte Consulting), Matt Langione (BCG) and Jean-François Bobier (also from BCG, on PQC).

My own talks

I did two presentations.

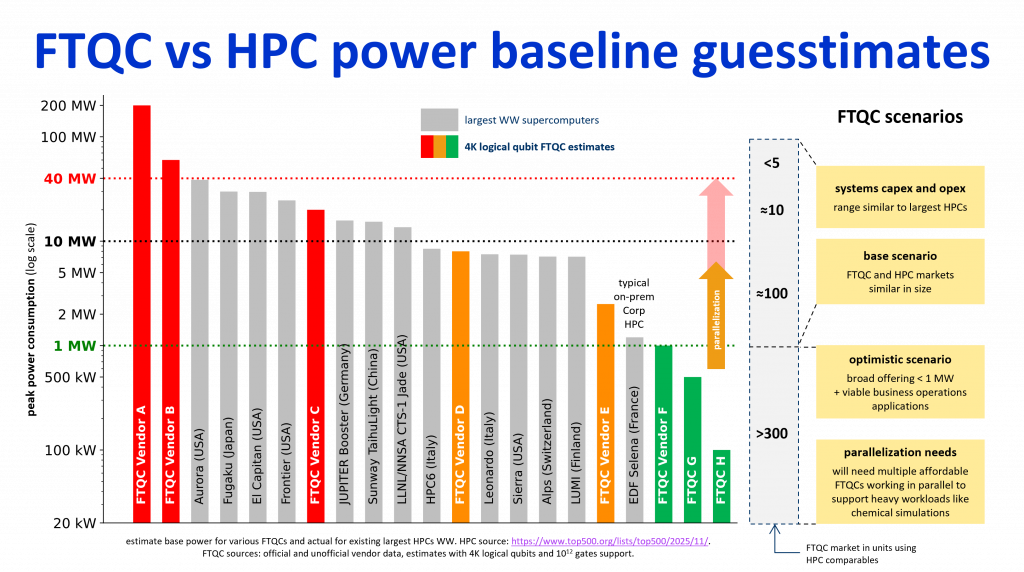

In a breakout session on the energetic challenges of FTQC (presentation) using a stance connecting FTQC energetics with the economics of this upcoming market. I explain that there won’t be any significant market and usage if FTQC systems energetic footprint is too high. This is summarized in slide 12. I provided a quick update on the whereabouts of the Quantum Energy Initiative. Addressing this question requires a multi-pronged approach including science, engineering, and economics. FTQC future power baseline is distributed across three orders of magnitude. The operational FTQC systems and their power baseline will condition their market size if using HPC comparables makes sense. It depends on the future state of the art of quantum algorithms. If these applications are mainly about physics and chemical simulations, the FTQC market may be inline with the HPC market which can therefore be used as a good comparable. If FTQC algorithms bringing practical speedups cover business operation applications including solving combinatorial optimization and machine learning problems, the FTQC market may then be much larger, provided the power and capex costs are reasonable, with the majority of applications being potentially run on the cloud. I also described a methodology in the making for optimizing the power and energy consumption of FTQC as well as its connection with computing times (will be detailed in a paper in preparation).

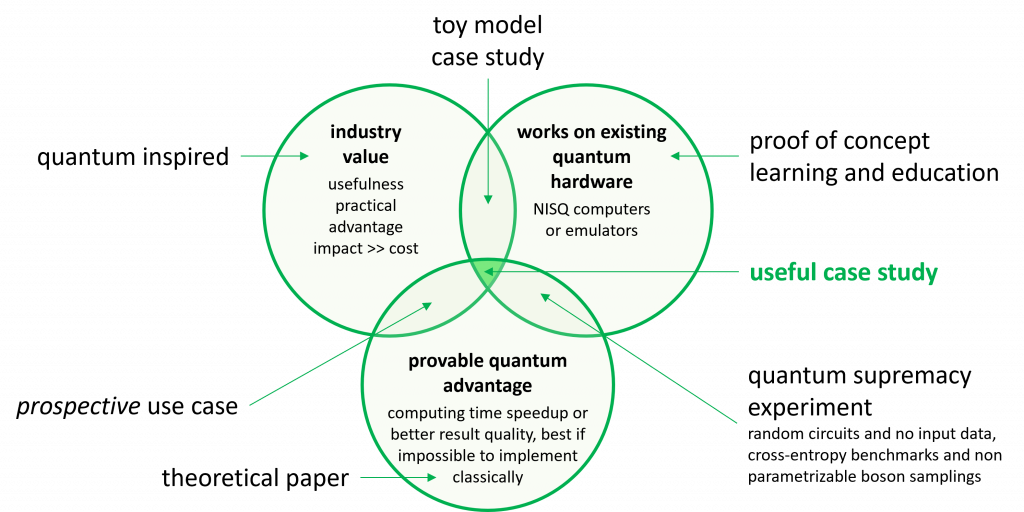

In plenary, on how to analyze quantum computing case studies (presentation) where I laid out a semantic distinction between use cases (application for future quantum computers), case studies (documenting existing and deployed applications), quantum supremacies (useless for practical applications) and so on (below) and described a simple methodology to look at the relevance of documented case studies and use cases. The good news is that we start to have real application case studies with some quantum advantage on analog and gate-based NISQ systems. They are, however, mostly limited to fundamental research applications, like in condensed matter, and not yet for industry cases.

Thanks for the organizers of the Q2B who invited me to deliver these two talks (Yuval Boger, Jean-Baptiste Faverjon).

The Q2B Santa Clara edition videos are usually published in January on YouTube. The next edition of the US Q2B will be in Chicago in 2026, and the European one will move from Paris to Copenhagen.

![]()

![]()

![]()

Reçevez par email les alertes de parution de nouveaux articles :

![]()

![]()

![]()

Articles

Articles